Allocating fuel tax revenues to mobility

The early 20th century was marked by a more widespread use of cars. The release of Ford’s T model, the first mass-produced model at an affordable price, “put America on wheels” and on a road network unsuited to the automotive revolution, which raised the issue of how its upgrading was to be financed.

Traditionally, US States used vehicle registration fees, firstly as a one-off payment and then as an annual tax; from 1919 and the introduction of a fuel tax, infrastructure construction became financed through an indirect tax collected on the fuel sales price.

Learn more / Download

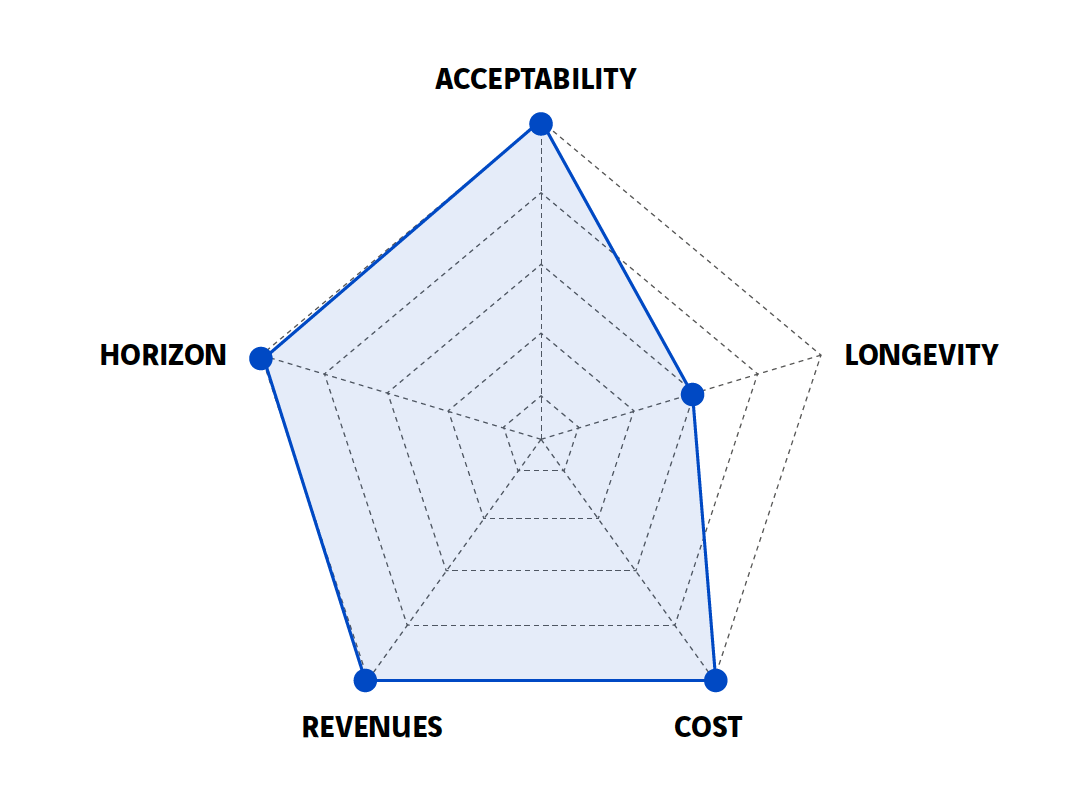

What scale of implementation?

- National

Who pays?

- Taxpayer

What secondary benefits for the community?

- CO2 emissions mitigation

Other solutions to discover

Putting a price on carbon to control emissions more effectively

Setting registration fees for electric vehicles

Kilowatt-hour fee: taxing electricity consumption in mobility

La Fabrique de la Cité

La Fabrique de la Cité is a think tank dedicated to urban foresight, created by the VINCI group, its sponsor, in 2010. La Fabrique de la Cité acts as a forum where urban stakeholders, whether French or international, collaborate to bring forth new ways of building and rebuilding cities.