Infrastructure usage rights: an analysis of the Eurovignette and the Swiss vignette

With the exception of the removal of the French vehicle vignette tax in 2000 and the shelving of the écotaxe in 2014, there is an upward trend in Europe for users’ contribution to funding road infrastructure. This trend is particularly clear in the road transport sector, in which various instruments intend to internalise negative externalities more effectively by acting on the price signal of traffic. Two instruments are commonly used for this purpose: the mileage charge for HGVs and the introduction of a road usage charge. The latter type of contribution is often implemented through the display of a vignette (sticker) which gives the holder the right to use all or part of the road network.

Learn more / Download

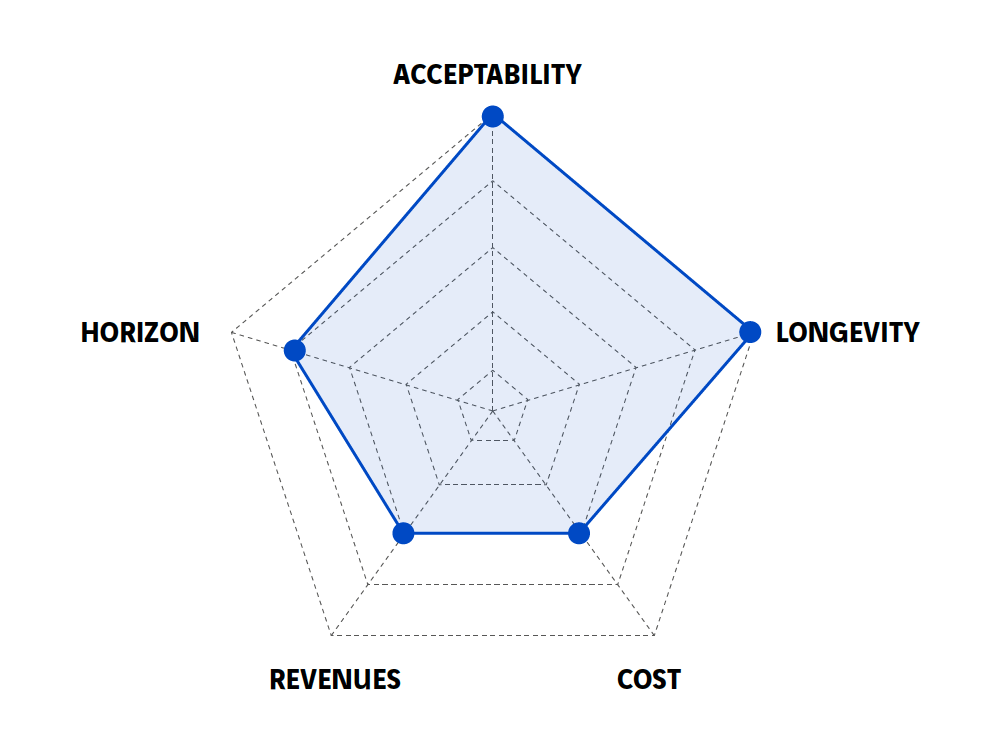

What scale of implementation?

- National

Who pays?

- Taxpayer

Other solutions to discover:

Putting a price on carbon to control emissions more effectively

Kilowatt-hour fee: taxing electricity consumption in mobility

Allocating fuel tax revenues to mobility

La Fabrique de la Cité

La Fabrique de la Cité is a think tank dedicated to urban foresight, created by the VINCI group, its sponsor, in 2010. La Fabrique de la Cité acts as a forum where urban stakeholders, whether French or international, collaborate to bring forth new ways of building and rebuilding cities.