Kilowatt-hour fee: taxing electricity consumption in mobility

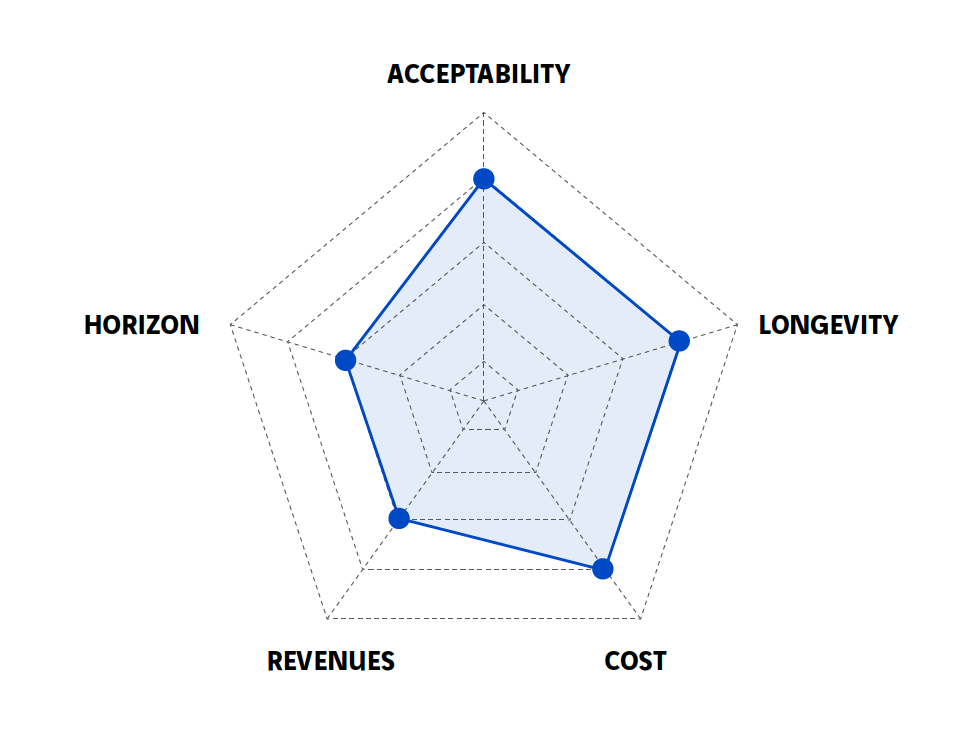

The difference between internal-combustion vehicles and electric vehicles cannot be summed up by engine type alone. The difference is also tax-related, as electric vehicles do not consume fuel and are therefore not subject to taxes on petroleum products. For the moment, electric vehicles only account for a small fraction of the car fleet in circulation. However, as the proportion of electric vehicles in circulation increases, the tax shortfall will also grow, making the use of a charge on the use of electric vehicles inescapable. Several solutions can be considered. One such solution would be to tax vehicle electricity consumption by importing the current fuel tax model: this would be a tax on electricity consumption (kWh fee), which considers electricity as an energy product that can be taxed like fuel.

Learn more / Download

What scale of implementation?

- National

Who pays?

- Taxpayer

Other solutions to discover:

Infrastructure usage rights: an analysis of the Eurovignette and the Swiss vignette

Putting a price on carbon to control emissions more effectively

Road usage charge: charging users rather than consumers

La Fabrique de la Cité

La Fabrique de la Cité is a think tank dedicated to urban foresight, created by the VINCI group, its sponsor, in 2010. La Fabrique de la Cité acts as a forum where urban stakeholders, whether French or international, collaborate to bring forth new ways of building and rebuilding cities.