Putting a price on carbon to control emissions more effectively

In France, alongside the construction sector, the transportation sector accounts for the most CO2 emissions, namely approximately 30% of national emissions. Due to the climate emergency, around 80 countries made a commitment to the UN to reduce their greenhouse gas (GHG) emissions significantly by 2050 or even 2030, under the Paris Climate Agreement. The carbon tax and carbon emission quotas are economic measures aimed at making polluters pay in proportion to their emissions (the polluter pays principle) and ultimately to steer companies’ and citizens’ behaviours and decisions towards a reduction in polluting emissions. Although many countries claim to be willing to apply an emission-sensitive tax, in 2018 only 21 countries and two Canadian Provinces had actually introduced an environmental tax on CO2emissions.

Learn more / Download

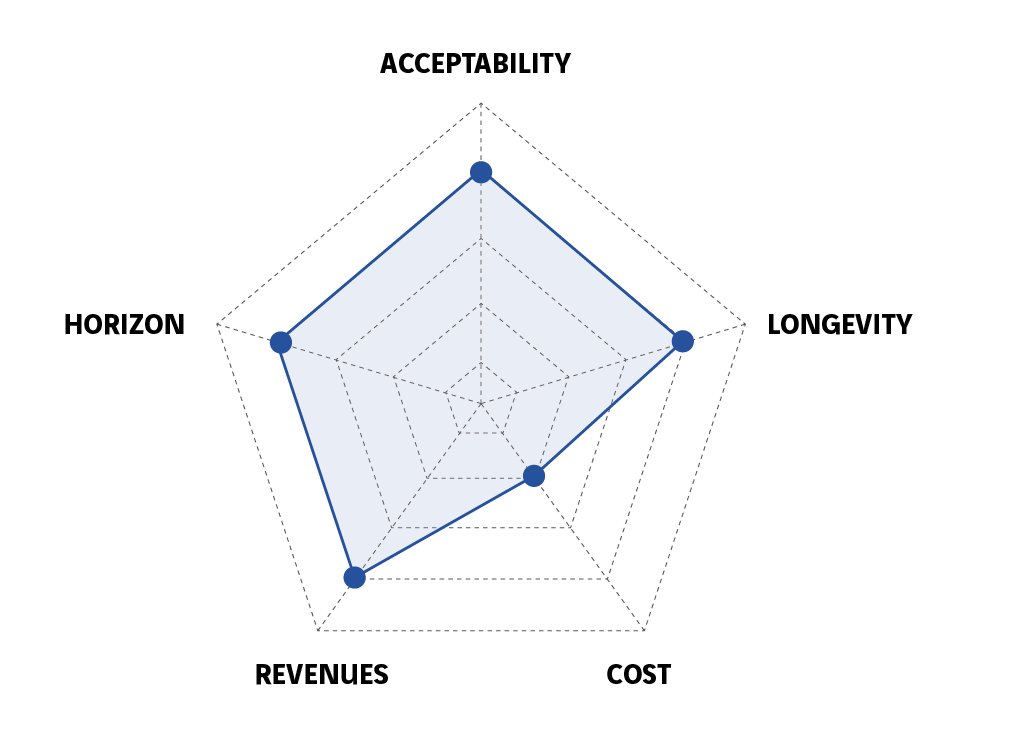

What scale of implementation?

- National

Who pays?

- Taxpayer

What secondary benefits for the community?

- CO2 emissions mitigation

- Modal shift toward less carbonized modes / behaviours

Other solutions to discover:

Infrastructure usage rights: an analysis of the Eurovignette and the Swiss vignette

Singapore and the issurance of a quota of licences to finance mobility

Kilowatt-hour fee: taxing electricity consumption in mobility

La Fabrique de la Cité

La Fabrique de la Cité is a think tank dedicated to urban foresight, created by the VINCI group, its sponsor, in 2010. La Fabrique de la Cité acts as a forum where urban stakeholders, whether French or international, collaborate to bring forth new ways of building and rebuilding cities.